You’ve successfully executed the BUILD phase: you designed a Minimum Viable Experiment (MVE), selected a laser-focused audience micro-segment, and time-boxed your effort to two weeks. Now you’re in the Measure phase, and this is where the discipline of the Lean Startup methodology truly separates successful ventures from those stuck on the treadmill of continuous effort and zero progress.

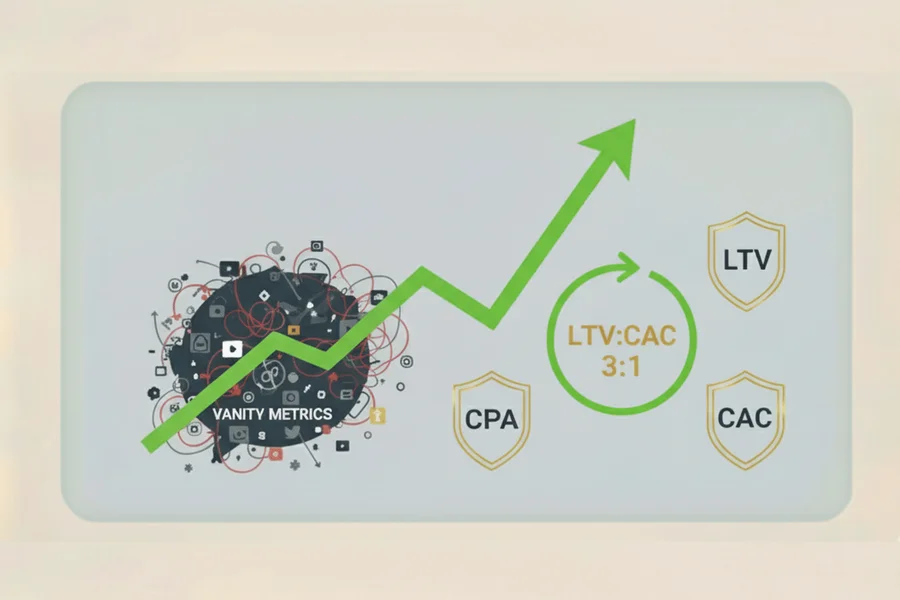

Progress is Validated Learning, Not Vanity Metrics

The purpose of measurement is not to generate dashboards full of green lights and inflated numbers. The goal is to generate Validated Learning—objective proof that your channel can reliably and profitably deliver new customers.

The Pitfall of Vanity Metrics

Most startups fail the Measure phase by optimizing for vanity metrics:

- Impressions: Did someone see our content? (Passive)

- Followers: Do people like our brand idea? (Soft commitment)

- Total Page Views: Did people generally visit the site? (Low intent)

These metrics feel good because the numbers always go up, but they tell you nothing about profitability. You can have millions of views and still go bankrupt. For a resource-scarce startup, every metric must tie directly back to unit economics. If the metric doesn't help you prove that your next 100 customers will generate more revenue than they cost, it’s a distraction.

1. The North Star: Tying MVEs to Unit Economics

The true measure of a marketing channel’s viability is its ability to deliver customers at a profitable rate. This requires an uncompromising focus on the three non-negotiable financial metrics that govern growth:

1. Customer Acquisition Cost (CAC)

CAC = Total Campaign Cost / New Paying Customers

What it measures: The cost to convince one person to become a paying customer.

Why it matters: In the MVE, your Total Campaign Cost includes all resources: ad spend, content creation time (calculated based on founder/employee salary), and tools used. This strict calculation forces you to be brutally honest about whether a channel is efficient. If you spend 20 hours of founder time to get one $10 customer, that channel is bankrupting you.

2. Customer Lifetime Value (LTV)

What it measures: The net profit attributed to the entire future relationship with a customer.

Why it matters: This is the ceiling on what you can afford to pay for CAC. Without a reliable LTV projection, you are operating blind. Even for an MVP, you must forecast a conservative, data-backed LTV based on anticipated retention, average order value, and gross margin. LTV is the fuel for scaling.

3. Conversion Rate (CR)

CR = (Desired Outcomes / Total Visitors) × 100%

What it measures: The percentage of visitors that take a predefined, high-value action (a purchase, a qualified demo request, or a paid signup).

Why it matters: CR is the ultimate metric for measuring funnel friction and message-market fit. A low CR on high-intent traffic means your landing page or product listing is confusing, slow, or fails to deliver the promised value. A high CR means the platform and your content are a perfect match for the user’s intent.

The Non-Negotiable Financial Rule: The LTV:CAC Ratio

Before you ever spend another dollar or minute scaling a channel, the MVE must prove that the economics are sound. The established gold standard for sustainable growth is the LTV:CAC ratio of 3:1.

CAC < 1/3 LTV

Why 3:1?

- 1 Part CAC: Covers the actual cost of acquiring the customer (the campaign expense).

- 1 Part Overhead: Covers the operational cost of serving the customer (salaries, software, cost of goods sold).

- 1 Part Profit: Ensures you have capital left to reinvest in growth, R&D, and managing unexpected churn.

If a channel delivers customers where the CAC is greater than 50% of LTV, you are operating in the danger zone. If CAC is equal to or greater than LTV, you are guaranteed to lose money on every customer, meaning the channel must be killed immediately.

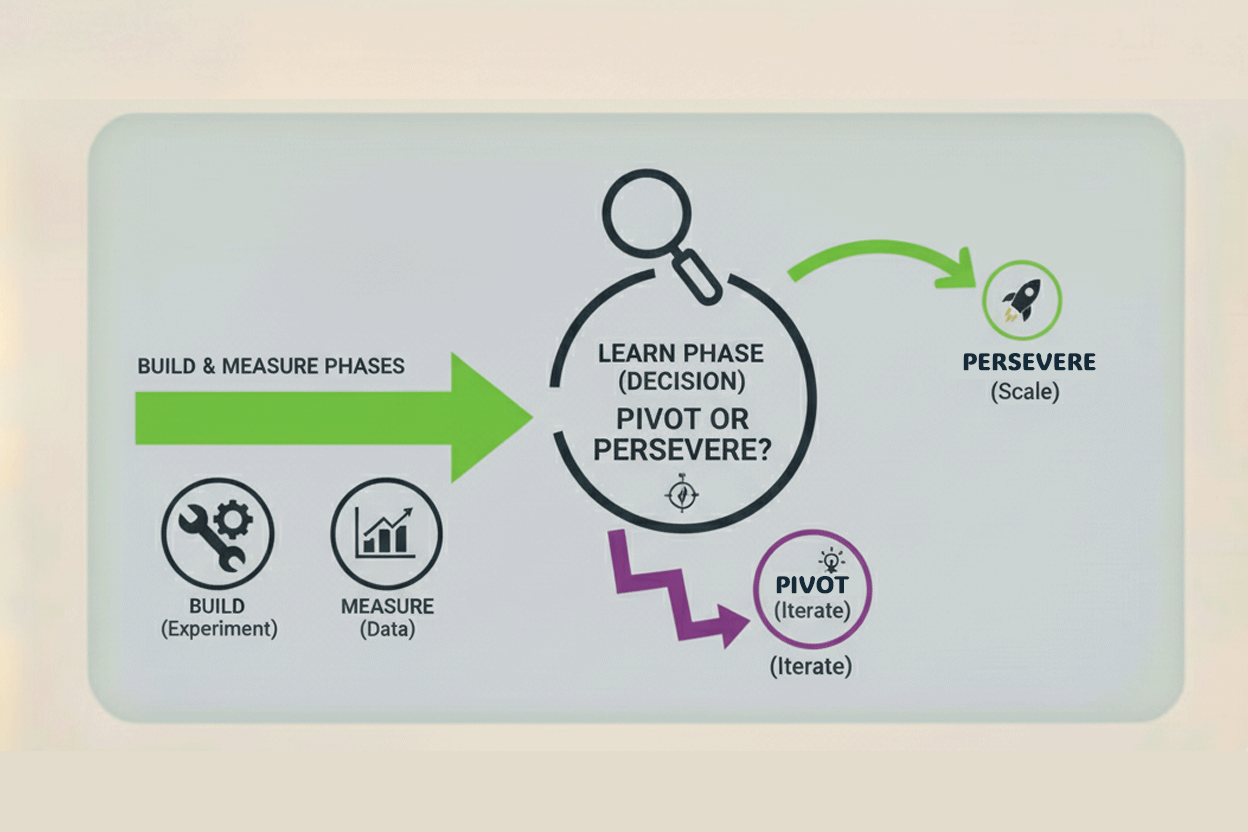

2. The MVE Decision Matrix: Removing Emotion from the Equation

The beauty of the MVE is that it removes emotion. You defined the success criteria in the BUILD phase; now, the Measure phase objectively confirms the outcome. This matrix serves as the final arbiter:

| Category | MVE Success Criteria (Persevere/Scale) | MVE Failure Criteria (Pivot/Kill) |

|---|---|---|

| Conversion Rate (CR) | CR meets or exceeds the industry benchmark or the required break-even rate. | CR is stagnant, remaining below the predefined MVE benchmark after the first week of data. |

| Customer Acquisition Cost (CAC) | CAC is confirmed to be ≤ 33% of projected LTV. | CAC is unacceptably high, leading to negative unit economics (e.g., CAC ≥ 50% LTV). |

| Validated Learning | Qualitative data (e.g., customer interviews) confirms key pain points and value proposition resonance. | Customer interviews reveal that assumptions about the core problem or solution were fundamentally wrong. |

Defining the CR Benchmark

A startup often lacks historical data, making it hard to define the CR benchmark. You must look outward:

- Marketplace CR: If you are testing Amazon, research the average CR for your product category (typically 5–15%). Your MVE must hit the low end of that range.

- Product Intent CR: If you are testing a B2B SaaS demo signup, a high-intent CR might be 1–2%. If you are testing an email newsletter signup on a blog post, a lower-intent CR might be 5–10%.

The goal is to define the CR that makes your LTV:CAC ratio work, and anything below that minimum is a failure.

The Non-Negotiable: Don't Forget Qualitative Data

The numbers (CAC, LTV, CR) tell you what happened, but they can't tell you why. Validated Learning is incomplete without Customer Development. The Measure phase demands you couple your quantitative analytics with deep qualitative interviews.

You must conduct 30–45 minute conversations with 15–20 individuals who engaged with your MVE content—especially those who didn't convert.

Who to Interview:

- The Converters: To understand what worked and validate your user persona.

- The Near-Converters (High Bounce Rate/Low CR): To understand the friction. Did the content promise X, but the landing page deliver Y? Was the price too high? Was the offer confusing?

Sample Qualitative Questions for the Measure Phase:

- “When you first saw our content on [Channel: e.g., TikTok/ChatGPT], what problem were you trying to solve?” (This validates your problem hypothesis.)

- “What was the single most confusing or friction-filled moment on the landing page/product listing?” (This validates CR/funnel assumptions.)

- “Before finding us, where else did you look for this solution?” (This validates your channel selection for the next MVE.)

This qualitative data provides the "why" behind your high CAC or low CR, saving you from scaling a successful channel that's attracting the wrong audience or scaling the wrong message.

3. The New Analytics Paradigm: AI Share of Voice (AISOV)

Traditional analytics tools—designed for the old Google-first world—are dangerously insufficient today. They fail because much of the fragmented buyer journey occurs in the "dark funnel."

The Dark Funnel Problem

When a user asks ChatGPT or Gemini, "What's the best software for X?", the AI generates a synthesized summary, often citing your brand without a direct link. The user then opens a new tab and searches for your brand name or navigates directly to your site. This traffic appears in Google Analytics (GA4) as generic "Direct Traffic."

This is problematic because Direct Traffic is often the highest converting traffic stream, making it impossible to attribute the value back to the actual source: AI Optimization (AEO) efforts. If you don't measure it correctly, you might kill a high-performing AEO MVE because it appears to be generating zero attributed revenue.

The Metrics for Fragmented Search

To solve the dark funnel problem, you need to track metrics that signify an actual customer journey starting on a fragmented platform:

A. Metrics for AI Answers (AEO)

Your MVE on AI answers must track competitive visibility, not just clicks:

- AI Mention Count: The total frequency your brand or product is cited in LLM/AI summary responses for target keywords (e.g., "best project management tool for small teams").

- AI Share of Voice (AISOV): Your brand's percentage of total market reach in AI responses versus key competitors. A 15% AISOV means you are capturing 15% of the market’s attention for a specific topic in the AI environment.

- Sentiment Score: For citations that mention you, track the sentiment. An AI model citing your product alongside positive reviews and current pricing is a significantly higher signal than a citation from a decade-old, irrelevant blog post.

Since AEO traffic has been shown to convert up to 700% higher than social media traffic (because the AI is pre-qualifying the customer), a positive trend in AISOV is a strong signal to Persevere, regardless of low traditional referral numbers.

B. Metrics for Social Search (TikTok/Instagram)

Social search content is primarily about demonstration and intent to return:

- High-Intent Mentions: Don't track all comments. Track comments that signal buyer intent: "I need this," "Where can I buy it?", "Is this still available?" These are direct demand signals.

- Saves/Shares: These metrics on platforms like TikTok and Instagram are far more valuable than likes. A Save or Share signifies intent to return to the content, often when the user is ready to make a purchase decision. It acts as an early-stage LTV predictor.

- Q&A Engagement: If you’re testing marketplaces like Amazon, monitor Q&A engagement and the conversion rate on your listing page (CR). Amazon buyers are already high-intent; if your CR is low there, the product description or price point is definitively wrong.

Summary and Next Steps

The Measure phase is about data discipline. It is where you transition from hoping you're right to knowing you're right—or knowing you're wrong.

To succeed in this phase:

- Enforce the 3:1 Rule: Your MVE must demonstrate an LTV:CAC ratio of 3:1 or better to scale.

- Integrate Qualitative Data: The "why" is more important than the "what." Use customer interviews to understand friction and validate assumptions.

- Track the New Metrics: Stop obsessing over impressions. Track AISOV, high-intent mentions, and Saves/Shares to capture the true value being generated in the fragmented dark funnel.

Once you have this objective data, you are ready for the final, most crucial step: the LEARN phase, where you make the definitive Pivot or Persevere decision.

No comments yet

Be the first to share your thoughts on this article!